Selling Merchandise Online in India: Market Entry Strategy, Tax Liability, Regulations

Posted by India Briefing Written by Naina Bhardwaj and Melissa Cyrill

We address key concerns in this brief guide about selling merchandise to India’s online market, including choosing the right business model, FDI norms, compliance, tax liability, and relevant regulations impacting e-commerce activity in the country.

India’s online market base

Spurred by increasing smartphone penetration, an expanding internet user base, and rising consumer wealth, e-commerce platforms and online applications have revolutionized the way business is done in India.

Estimated to be worth US$85-90 billion in the calendar year (CY) 2020, India’s digital economy is expected to grow about 10 times to reach US$800 billion by 2030 as per consultancy firm RedSeer. The firm projects that by CY 2030, India’s digital economy will cover 60 percent of the travel sector, 40 percent of non-grocery retail, 30 percent of the education market, 25 percent of food and beverages (F&B) services, and six percent of the pharmaceutical/market. Further, the online retail market is projected to generate annual gross merchandise value (GMV) of US$350 billion by CY 2030.

India’s online market appeal is thus quite significant. The country has a large urban population in congested metropolitan cities as well as new market bases in rapidly growing Tier 2 and Tier 3 cities. The city-tier calculation in India is done on the basis of population size, not development levels, and have benefited from a reverse migration in recent years as more young professionals seek to relocate from major cities due to high living costs, pollution levels, new opportunities in a flexible or remote work environment, and improved transport connectivity.

For similar reasons, more companies are also setting up satellite offices or manufacturing bases in Tier-2 and Tier-3 cities as recruitment and logistics prospects have improved and ensure competitive operating margins. Consequently, several lower tier cities like Chandigarh, Jaipur, Indore, Ahmedabad, Indore, Coimbatore, Kochi, etc. besides metropolitan centers like Delhi, Mumbai, Bangalore, Hyderabad, and Chennai, boast of trend-conscious consumers with rising disposable incomes.

Meanwhile, the pandemic has acclimatized Indian consumers into adopting digital solutions for a whole range of transactions – from payments and buying merchandise to accessing services. Online retail channels are increasingly integrated on e-marketplaces like Amazon, Zomato, Myntra, etc. as well as social media platforms like Facebook and Instagram.

This is also witnessed in the preference for or interest in online business service segments like education, gaming, fitness, and financial services. Such growth trends and shifting consumer patterns create highly attractive opportunities for foreign companies.

Step-by-step guide on how to sell online in India

Market research

The first step is working out what product(s) are to be sold and market research for the same.

Once the cost feasibility is ascertained, it is important to create a digital catalogue of the products to be sold, which includes product code, product name, description, category, selling price, discount (if any), brand, color, and other applicable attributes.

Choosing the right business model

Build own e-commerce website Setting up a proprietary e-commerce website is suitable if the seller has a unique product to sell.

However, it is both expensive and time consuming and requires a long time to establish market presence. It requires the setting up of an online store, integrating a secure payment gateway, and building a logistics chain, among other tasks. It is suitable for sellers who are looking for a long-term setup and intend to focus on building their brand name.

Sell on an established e-commerce marketplace

Selling on an already established marketplace like Amazon, Myntra, or Flipkart is the easiest and most convenient way to sell products online, where the seller need not focus on developing logistics, payment gateway, or delivery channels as they are catered to by the marketplace.

Foreign merchants can join any of these marketplaces. The process requires registering the company, obtaining a tax number, and opening a bank account. The marketplace will take care of logistics and payments.

Tapping into social media as a marketplace model

Social network platforms, short form video and image platforms, and chat-based like Facebook, Instagram, WhatsApp, Twitter etc. have gained popularity due to their increased outreach among the consumers.

Besides they are now an inevitable part of the digital marketing strategy of e-commerce and offline retail players to enhance their presence and visibility among the consumer base.

Registering the business

There are three modes of registering the business entity in India.

- Sole proprietorship;

- Private or public limited company; and

- Limited liability partnership (LLP).

A sole proprietorship is a very common business structure in India. It’s a single person establishment and is cost-effective because no minimum capital investment is required. The owner only has to file an annual tax return and pay individual tax.

Foreign companies interested in establishing a wholly owned subsidiary in India can do so by setting up a private limited company. A private limited company is often considered the most suitable option for smaller companies as well as foreign companies owing to a relatively easier, less expensive, and less stringent registration process; it also requires fewer documents as compared to an LLP, which has stricter FDI regulations.

Taxation

The tax on foreign entities in India is based on different aspects, such as place of income, source of income, and presence of the entity in India.

The mere presence of a subsidiary company in India does not automatically make it a permanent establishment (PE) of the parent company. To make a subsidiary a PE, the parent company’s operations must be conducted through the subsidiary company, as defined by the other PE provisions.

Tax implication varies based on entity type: wholly owned subsidiary – up to 30 percent, LLP – 30 percent, branch office – 40 percent, liaison office – not applicable.

Consequences of establishing a PE in India

Once it is determined that a foreign firm has a PE in India, profits linked to its activities in India will be taxed as “Business Income” in accordance with Article 7 of the double tax treaty.

Profits due to a PE are the profits that the PE would have made if it had operated independently in the same or comparable activities within the same or similar conditions as the rest of the company. They have to compulsorily maintain books of accounts. They must apply for PAN, TAN, and should be registered under regulations of indirect tax like GST.

Expenses incurred for the purpose of the PE’s business, whether incurred in India or elsewhere, are allowed as tax-deductible expenses for determining the PE’s earnings. The net profits will subsequently be subject to the taxation that a foreign company would face in India. Mandatory compliance of withholding tax (WTH).

Logistics

An established marketplace will take care of the logistics. However, if the business decides to launch their own e-commerce store, logistics demand more in terms of both time and cost. Moreover, investing in efficient logistics will prove beneficial in terms of the company’s brand image over the long run.

International logistics players, such as FedEx, DHL, and UPS, operate in India as well as players like DTDC, Bluedart, DHL, etc.

Since the mid-2010s, several new technology-led start-ups and logistics platforms have set up to provide end-to-end e-commerce logistics service solutions, manage freight and shipping transportation, and provide AI-enabled warehousing, such as Delhivery, Rivigo, XpressBees, Dunzo, Ecom Express, BlackBuck, FarEye, Elastic Run, ShipRocket, and GreyOrange. These are introducing efficiencies into India’s notoriously fragmented supply chain ecosystem and ensuring that easier e-commerce reach to interior regions in India.

Payments

Along with setting up a payment gateway in case of setting up their own e-commerce site, it is important to cater to the cash on delivery (COD) option, which is highly popular among the Indian consumers. However, the COD option is expensive for merchants who have to pay multiple fees along with courier charges.

Nevertheless, with increased digitization, digital wallets and payment apps, such as Paytm, PhonePe, and GooglePay, are gaining popularity. Another driver of digital payments growth is the Unified Payments Interface (UPI), which is an instant real-time payment system developed by the National Payments Corporation of India facilitating inter-bank peer-to-peer and person-to-merchant transactions. Induced by the fear of surface contact during the pandemic, adoption of digital payments has become a necessity, triggering behavioral changes even among hesitant consumers and businesses.

Data from India’s central bank show the rising popularity of digital payments in the country. The total volume of digital payments in non-cash payments increased to 98.5 percent during 2020-21 as compared to 92.5 percent in 2017-18. Moreover, data gathered by the National Payments Corporation of India in 2020 revealed that one-third of Indian households used some form of digital payments, including 25 percent of the bottom 40 percent income class. In October 2021 alone, India recorded 4.2 billion UPI transactions amounting to about US$103 billion.

India’s e-commerce industry trends, and key players

Led by e-commerce giants like Amazon India, Flipkart, Myntra etc., the Indian e-commerce market has steadily picked up pace over the last 15 years due to favorable market conditions and policy support. Although the e-commerce industry experienced a temporary setback due to the pandemic (except for specific segments pertaining to daily consumption needs) in 2020, the loss of momentum quickly reversed its tracks going into 2021.

Looking towards 2022, the online retail sector has much to anticipate with the upsurge of several first-time shoppers becoming increasingly familiar and dependent on internet-based platforms. In the online retail market, consumer electronics and apparel grab the majority share. In the online apparels segment, e-marketplace platforms like Myntra, Jabong, Ajio, and Limeroad are leading the race by making fashion more affordable to the masses.

Over the last year, major apparel and cosmetic giants like H&M, Uniqlo, Zara, Marks & Spencer, and MAC, have also worked on increasing their online presence in India. H&M and MAC have adopted an omni-sales strategy by tapping existing aggregators like Myntra and Nykaa to boost short-term sales as well launching their own shopping websites to build online brand image and secure loyal customers online.

Meanwhile, the Indian online food and grocery segment is heating up, fueled by fierce competition among start-up platform players like Flipkart, BigBasket, Zomato, and Swiggy as well as the entry of Amazon and traditional retail conglomerate Reliance JioMart.

Consumers are offered a range of products and deals in almost every segment, each platform aggregator and retail mobile app seeking to capture loyal shoppers. This slow but steady trend reflects RedSeer’s estimates that the total size of India’s e-grocery market would grow from US$1.9 billion in 2019 to US$3 billion by 2020. However, it is more than likely that the pandemic’s exigencies have sped up the online market growth.

The decision to allow 100 percent FDI in entities engaged in food retail, including online, through the approval route, has also boosted investment appeal. The government also allows 100 percent FDI in the food processing sector.

Lockdowns under the pandemic broadened the perceptions of kirana store owners (family-owned / mom-and-pop shops) across the country, who were previously skeptical of integrating with the e-commerce sector.

The 12 million-strong network of kirana shop owners capture the lion’s share of India’s retail market and their integration with e-commerce platforms is set to ensure seamless delivery of merchandise along the length and breadth of the country. Flipkart has partnered with 27,000 kirana stores across 700 cities, while Amazon has partnered with 20,000 kirana stores. Reliance’s JioMart has also come forward to provide digital terminals to offline shopkeepers, for inventory management and stock ordering from Reliance’s network of wholesalers.

The integration of micro, small, and medium enterprises (MSMEs) with major aggregators is also illustrated by Flipkart’s decision to connect with over 5,000 offline branded retail stores from over 300 cities during its major sales festival, Big Billion Days, held in early October. Flipkart wants to onboard 10,000 MSMEs by the end of 2021. Its main rival, Amazon, has over 850,000 sellers on its platform that include more than 75,000 local stores from 450 cities as well as sellers under programs like Amazon Launchpad, Amazon Saheli, and Amazon Karigar. In a Nielsen survey commissioned by Amazon, between August 30 and September 9, 2021, 78 percent of the 1,965 sellers surveyed reported they were looking to reach new customers and 71 percent predicted a sales boost.

Drivers of e-commerce industry growth in India

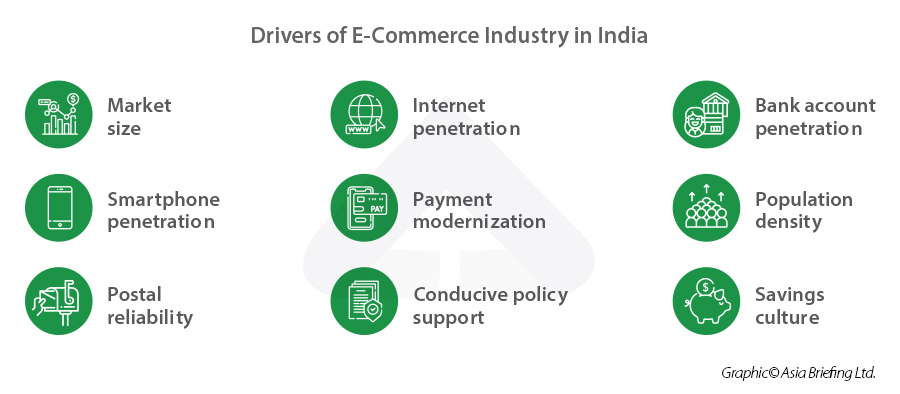

Boasting a huge market size with a relatively young demography, India adds approximately 10 million daily active internet users each month.

Rising population and disposable incomes in Tier 2 and Tier 3 cities along with the underserviced rural market promise immense potential in the sector. The smartphone penetration per 100 people has increased from 5.4 in 2014 to 26.2 in 2018.

The number of internet connections in India increased from 560 million in 2018 to 760 million in 2020.

The modernization of digital payments infrastructure, backed by BHIM/UPI and NEFT, has thrust India’s e-commerce growth by facilitating ease of pay.

Start-up digital wallet players, like Paytm, PhonePe, MobiKwik, etc. also cater to the large unbanked population.

Other factors like improving last mile delivery of services along with increased bank account penetration with aid of enabling initiatives like JAM trinity (Jan Dhan-Aadhar-Mobile) have contributed to the impressive rise of the e-commerce industry.

Rise of the social commerce business model

Social media is among the most potent modern digital marketing tools, especially given the amount of time we spend on our smartphones on average.

More interestingly, these social media channels are also evolving into new e-marketplaces. The outreach of social media has led to the development of a new segment, social commerce, an internet-based model for small and medium-sized businesses.

As per the Indian government, WhatsApp (530 million users), YouTube (448 million users), Facebook (410 million users), Instagram (210 million users), and Twitter (17.5 million users) reportedly have a collective reach of over 1.61 billion users in India, thereby providing amplified scope for product discovery besides enabling the direct communication on products between buyers and sellers.

Instagram, for example, allows businesses to photo share, do video calls, and host polls, which improves their business planning as they get a pulse on niche or new trends and can develop products to market accordingly.

Given that many social commerce businesses tend to have smaller working capital, this flexibility and consumer engagement can be invaluable. Further, the rise of the social media influencer as an established new marketing approach will inevitably strengthen the exposure of social commerce businesses.

Adapting the model, established e-commerce marketplaces are also exploring ways to tap into SME and/or hyperlocal businesses, like Flipkart, which recently launched an independent platform 2GUD to connect offline stores with customers, and showcase products through long-format videos.

Other business models that have spun out of the social commerce space are the reselling and group buying models. Major examples of social reselling platforms are Meesho, GlowRoad, Shop 101, Bulbul, and SimSim – the users of these platforms/apps are called resellers.

The benefits that these platforms include digital inventory of products sourced from suppliers at wholesale prices, logistical services, customer service, integration with social media channels, and even the option of free personal sub-domain and storefront (GlowRoad). For example, Bengaluru-based Meesho app provides an alternative distribution channel for suppliers to list their wide-ranging product catalogs, which can be sourced by individual entrepreneurs by leveraging their contacts on social media. It is also one of the most-funded start-ups in the sector, counting Facebook, Sequoia Capital, Shunwei Capital, SAIF Partners, Y Combinator, among its investors. According to the company, Meesho has “built a network of two million ‘social sellers’, nearly 80 percent of which are women… selling goods from over 15,000 suppliers in over 700 small towns. Its app is available in seven local languages, with 40 percent of its daily active users (DAUs) consisting of the non-English speaking population.” In September, Meesho raised US$570 million from US-based asset manager Fidelity and Eduardo Saverin’s B Capital and in late October, it was reported that Google has been in talks to invest US$50-75 million in the social commerce platform. Google has already backed startups Dunzo (delivery service platform) and InMobi’s Glance (AI-based software company delivering personalized content to lock screens of smartphones).

Regulations impacting e-commerce in India

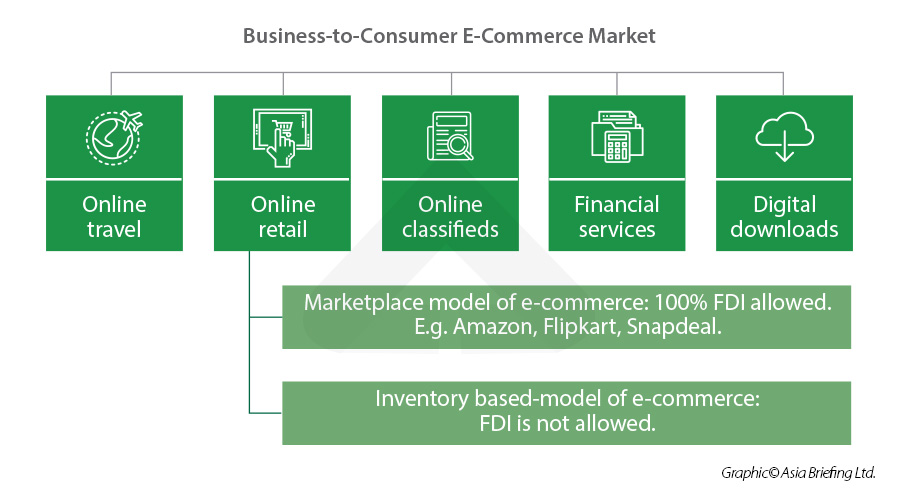

E-commerce policy: The Government of India’s Draft National E-Commerce Policy encourages FDI in the marketplace model of e-commerce. According to the draft, a registered entity is needed for the e-commerce sites and applications to operate in India.

Bharat Net and Digital India: Under the Digital India movement, the government has launched various initiatives like Unified Mobile Application for New-age Governance (UMANG), Bharat Interface for Money (BHIM) etc. to boost digitization. BHIM has made possible to link payments directly through banks, which does away with the need to transfer money to mobile wallets first, as was earlier required by apps like Paytm, PhonePe etc. Most private players have adopted BHIM UPI to make digital payments. Massive budgetary allocations in FY2021-22 amounting to US$95.33 million have also been made to further the objective of mass digitization in India.

RBI’s Credit/Debit Card Recurring Payment Rules: The Reserve Bank of India’s framework for processing e-mandates on recurring online transactions has made AFA (Additional Factor of Authentication) mandatory for all recurring transactions below INR 5,000 on debit cards, credit cards, UPI, and other prepaid payment instruments (PPIs). All stakeholders were mandated to ensure full compliance with the framework by September 30, 2021. This applies to all recurring payments where amounts are debited automatically from customers’ cards (credit/debit/prepaid) for recurring mobile, utility, and other bills as well as subscription payments like OTT-streaming services.

National Retail Policy: The government has proposed a National Retail Policy in which it acknowledged five key areas – ease of doing business, rationalization of the license process, digitization of retail, focus on reforms, and an open network for digital commerce. The proposed policy aims to integrate the administration of offline retail and e-commerce.

Consumer Protection (E-Commerce) Rules 2020: These Rules direct e-commerce companies to display the country of origin alongside product listings. In addition, they will also have to reveal parameters like product image, product title, product description, product features, product ratings, and product review that will determine product listings on e-commerce platforms. Considering that the Indian market is still adapting to online shopping, these requirements will ensure the credibility of the seller and boost consumer confidence.

Open Network for Digital Commerce: In order to provide easy access to all, including small traders and producers, the Department for Promotion of Industry and Internal Trade (DPIIT) set up a steering committee in November 2020 for formulation, implementation, and policy oversight of Open Network for Digital Commerce (ONDC). It will be a neutral platform that will work to set protocols for cataloguing, vendor discovery, and price discovery. Their aim is to provide equal opportunities to all marketplace players, including the consumers.

5G network roll-out: Substantial investments have been made by the Government of India in rolling out fibre network for 5G, which will help boost Ecommerce in India.

What do India’s Draft E-Commerce Rules, 2021 say and why is it unpopular with stakeholders?

At present, e-commerce in India is regulated through Consumer Protection (E-Commerce) Rules, 2020 under the Consumer Protection Act, 2019.

In June 2021, fresh amendments were announced to bring transparency on e-commerce platforms and further strengthen the regulatory regime to curb perceived unfair trade practices. The amendments proposed in Draft E-Commerce Rules, 2021 call for the following changes:

- Mandatory registration.

- Limiting flash sale: The original proposal placed a blanket ban on all flash sales. However, a later clarification stated it will not apply for conventional flash sales. No clarity yet on the meaning of conventional sales.

- No e-commerce entity should indulge in mis-selling of goods and services.

- E-tailers shouldn’t permit usage of their names for brands if such practices amount to unfair trade practices.

- E-tailers shouldn’t mislead users by manipulating search results.

- E-tailers shouldn’t allow misleading ads potentially impacting pricing, quality, and guarantee.

- Country of origin clause: Requirement for identifying goods based on their country.

Major concerns raised by industry and ministerial stakeholders are with regards to:

- Ambiguity regarding the definition of “Related Party”: The draft rules state that none of an e-commerce entity’s related parties can be enlisted as a seller to consumers directly. This will pose difficulty for both foreign and domestic players like Amazon, Flipkart, 1mg, Netmeds, etc. to sell on their super-apps.

- Issue over fall-back liability: The rules have introduced the concept of fall-back liability, which makes the e-commerce firms liable in case a seller on their platform fails to deliver goods or services due to negligent conduct, which causes loss to the customer.

- Overreaching jurisdiction by the consumer affairs department.

Several ministries, including the Ministry of Finance and Ministry of Corporate Affairs have labelled the proposed amendments excessive. Niti Aayog has expressed concern that such tight regulations will hurt ease of doing business in India. Therefore, a revision in the proposed norms is soon expected.

About Us

India Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Delhi and Mumbai. Readers may write to [email protected] for more support on doing business in in India.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, Singapore, Vietnam, Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.