Electric Vehicle Industry in India: Why Foreign Investors Should Pay Attention

Posted by India Briefing Written by Naina Bhardwaj

The electric vehicle industry in India is picking pace with 100% FDI possible, new manufacturing hubs, and increased push to improving charging infrastructure. Federal subsidies and policy favoring deeper discounts for Indian-made electric two-wheelers as well as a boost for localized ACC battery storage production are other growth drivers for the Indian EV industry.

The global automotive industry is undergoing a paradigm shift at present in trying to switch to alternative/less energy intensive options. India, too, is investing in this electric mobility shift.

The burden of oil imports, rising pollution, and as well as international commitments to combat global climate change are among key factors motivating India’s recent policies to speed up the transition to e-mobility.

Electric Vehicle Industry in India: Growth targets

The Indian automotive industry is the fifth largest in the world and is slated to be the third largest by 2030. Catering to a vast domestic market, reliance on the conventional modes of fuel intensive mobility will not be sustainable. In an effort to address this, federal policymakers are developing a mobility option that is “Shared, Connected, and Electric” and have projected an ambitious target of achieving 100 percent electrification by 2030.

By making the shift towards electric vehicles (EVs), India stands to benefit on many fronts: it has a relative abundance of renewable energy resources and availability of skilled manpower in the technology and manufacturing sectors.

According to an independent study by CEEW Centre for Energy Finance (CEEW-CEF), the EV market in India will be a US$206 billion opportunity by 2030 if India maintains steady progress to meet its ambitious 2030 target. This would require a cumulative investment of over US$180 billion in vehicle production and charging infrastructure.

Another report by India Energy Storage Alliance (IESA) projects that the Indian EV market will grow at a CAGR of 36 percent till 2026. The EV battery market is also projected to grow at a CAGR of 30 percent during the same period.

Existing EV ecosystem in India and investment outlook

Regardless of the country’s ambitious targets, India’s EV space is at a nascent stage. However, looking at it differently – India offers the world’s largest untapped market, especially in the two-wheeler segment. 100 percent foreign direct investment is allowed in this sector under the automatic route.

The federal government is also prioritizing the shift towards clean mobility, and recent moves to amend the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles in India (FAME) II scheme to make electric two-wheelers more affordable, is a case in point.

The government has also rolled out a Production-Linked Incentive Scheme (PLI) for ACC Battery Storage Manufacturing, which will incentivize the domestic production of such batteries and reduce the dependence on imports. This will support the EV industry with the requisite infrastructure and will significantly cause a reduction in cost of EVs. Many leading battery producers like Amara Raja Batteries, are picking cue from theses incentives to orient new investments into green technologies, including in lithium-ion batteries.

Responding to the opportunity that India’s EV industry presents, leading players like OLA Electric Mobility Pvt, Ather Energy, and Mahindra Electrics are rapidly growing their market presence. Moreover, certain states like Karnataka and Tamil Nadu are rolling out innovative and timely investor-friendly policies besides building necessary infrastructure.

Recently, the American electric vehicle and clean energy company Tesla Inc. marked its entry into India by incorporating its subsidiary, Tesla India Motors and Energy Pvt Ltd, in Bengaluru.

In February 2021, Ather Energy, India’s first intelligence EV manufacturer moved its US$86.5 million factory from Bengaluru (Karnataka) to Hosur (Tamil Nadu). Ather Energy’s factory is said to have an annual production capacity of 0.11 million two-wheelers.

In March 2021, Ola Electric, the subsidiary of the unicorn Indian ride-hailing start-up, also announced that it would be setting up the world’s largest electric scooter plant in Hosur (which is a two and a half-hour drive from Bengaluru) over the next 12 weeks, at a cost of US$330 million, and aiming to produce 2 million units a year. By 2022, Ola Electric wants to scale up production to pump out 10 million vehicles annually or 15 percent of the world’s e-scooters.

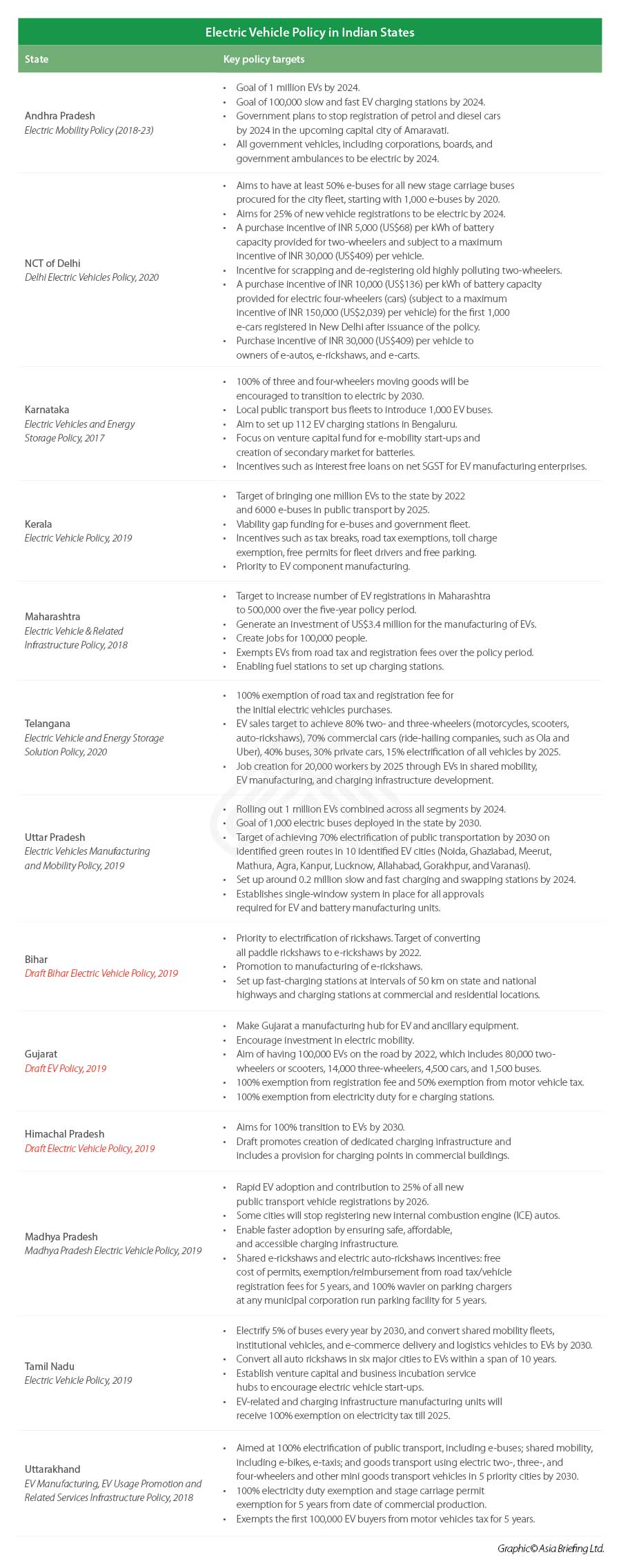

There have also been positive developments in the expansion of charging infrastructure across the country – states like Andhra Pradesh, Uttar Pradesh, Bihar, and Telangana are setting impressive targets for the deployment of public charging infrastructure to increase uptake of electric vehicles in the country.

Recently, Sterling and Wilson Pvt Ltd (SWPL), India’s leading engineering, procurement, and construction company announced its entry into the electric mobility segment in India. It has signed a 50-50 joint venture with Enel X, to be incorporated on April 1, 2021, to launch and create innovative charging infrastructure in India.

The key reasons why these states are doing better than others are local fiscal sops, better logistics, an investor-friendly government policy, business facilitation through easier access to authorities, supply chain connectivity, and the availability of suitable land.

Karnataka was the first state to introduce a comprehensive EV policy and has emerged as a hotspot for EV businesses in India, both in EV and EV ancillary manufacturing as well as R&D segments. Tamil Nadu is also leaping forward at a commendable pace, owing to its supply ecosystem, larger land parcel, proximity to ports, and proactive investor support through administrative portals like Guidance Tamil Nadu.

Nevertheless, while growth in the EV industry is on an upward tick, it has much ground to cover to be able to realize the government’s ambitious 2030 target. The COVID-19 pandemic not only slowed the industry’s progress, but also dampened overall market demand.

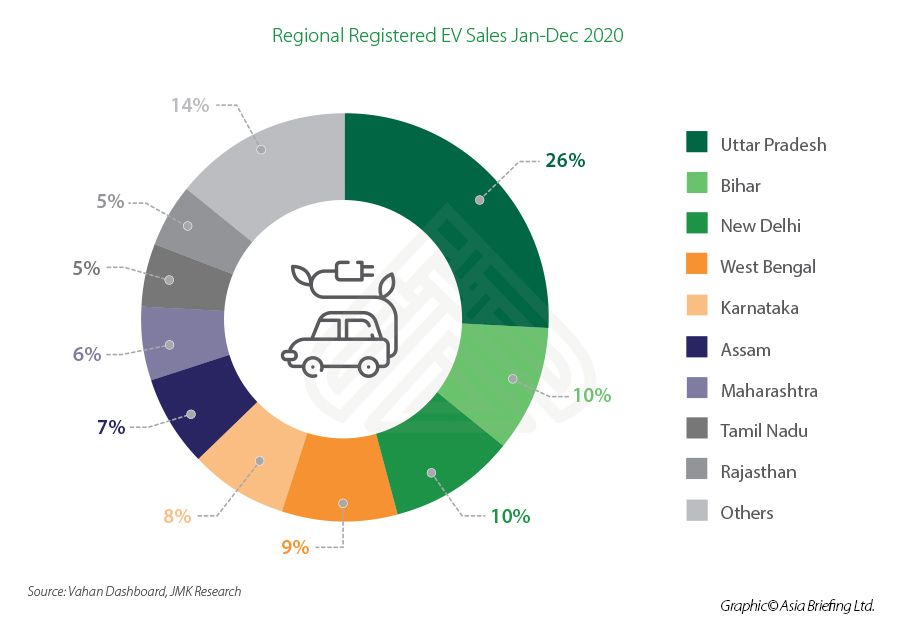

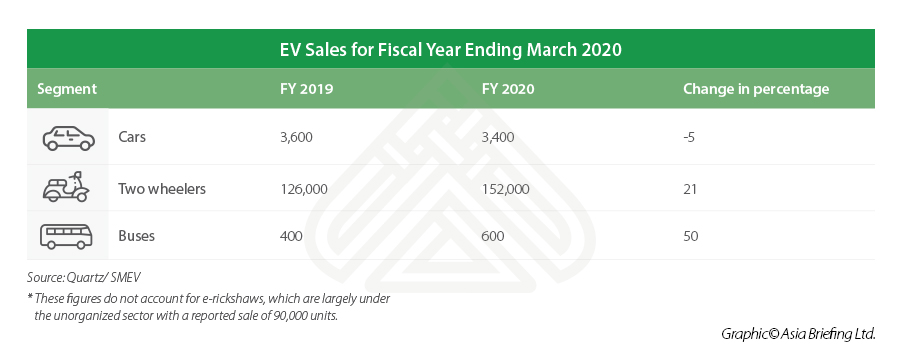

Still, market sentiment has retained positivity in some segments. In FY 2020, EV sales for two-wheelers in India increased by 21 percent. For EV buses, the sales for the same period increased by 50 percent. In contrast, the market for electric cars remained grim, registering a five percent decline. As for total EV sales, after suffering an initial setback in 2020, sales appear to be slowly picking up. In January 2021, 15,910 units of EVs were sold in India, and out of these, the maximum units were sold in Uttar Pradesh, followed by Bihar and Delhi.

India’s EV market: Growth projections and government policy

Projections

In April 2019, Niti Aayog, the federal think tank, published a report titled “India’s Electric Mobility Transformation”, which pegs EV sales penetration in India at 70 percent for commercial cars, 30 percent for private cars, 40 percent for buses, and 80 percent for two- and three- wheelers by 2030. These targets, if achieved, could lead to a net reduction of 14 exajoules of energy and 846 million tons of CO2 emissions over the deployed vehicles’ lifetime. Electric vehicles sold until 2030 can cumulatively save 474 million tons of oil equivalent over their lifetime, worth US$207.33 billion.

This will help India fulfil its global commitments to lower carbon emissions and increase use of cleaner sources of energy and transportation as required by the Nationally Determined Contributions (NDCs) under the United Nations Framework Convention on Climate Change (UNFCCC) and EV30@30.

Policy measures

Federal policy

Several fiscal and non-fiscal measures have been put in place to facilitate the adoption of electric mobility. They are as follows:

- National Electric Mobility Mission Plan 2020 (NEMMP): It was launched in 2013 by the Department of Heavy Industry (DHI) as a roadmap for the faster manufacture and adoption of EVs in India.

- FAME Phase I: As part of the NEMMP 2020, the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles in India (FAME India) Scheme was notified in April 2015, to promote the manufacture of electric and hybrid vehicle technology. It has mainly focused on four aspects – demand creation, technology platform, pilot projects, and charging infrastructure. For demand creation, incentives have mainly been disbursed in the form of reduced purchase prices.

- FAME Phase II: Launched in 2019 for a period of three years, this scheme has an outlay of US$1.36 billion to be used for upfront incentives on the purchase of EVs as well as supporting the development of charging infrastructure. FICCI has asked for continuation of FAME II till 2025, along with short-term booster incentives to enhance demand.

- Amendments to FAME Phase II: On June 11, 2021, the Ministry of Heavy Industry announced further amendments to the FAME II scheme to give a boost to EV demand among consumers. Under the revised policy, the subsidy per electric two-wheeler (Indian-made), which is linked to the battery size, has been increased to INR 15,000 (US$204.60) per Kilowatt-hour (KWh) from INR 10,000 (US$136.40) KWh. Furthermore, electric two-wheeler manufacturers can now give discounts of up to 40 percent to consumers, which is a significant raise from the previous cap of 20 percent. The eligibility criteria for these electric two-wheelers to qualify for subsidy under the FAME II scheme include a minimum range of 80 km on single charge and a minimum top speed of 40 km per hour. These incentives are expected to significantly lower the purchase price and lift buyer sentiment, creating a spur in market demand. The amendments in the policy have been hailed by industry stakeholders who are now expecting the EV two-wheeler industry to clock sales of over six million units by 2025. Yet, according to a recent CRISIL report, 95 percent of the e-scooters in India are not eligible for the FAME II incentive scheme, as they fail to meet the eligibility criteria.

- Ministry of Power: It has clarified that charging EVs is considered a service, which means that operating EV charging stations will not require a license. It has also issued a policy on charging infrastructure to enable faster adoption of EVs.

- Ministry of Road Transport and Highways: It has announced that both commercial as well as private battery-operated vehicles will be issued green license plates. It has also notified that all battery operated, ethanol-powered, and methanol-powered transport vehicles will be exempted from the commercial permit requirement.

- Department of Science and Technology: It has launched a grand challenge for developing the Indian Standards for Electric Vehicle Charging Infrastructure.

- Niti Aayog: The National Mission on Transformative Mobility and Battery Storage has been approved by the cabinet, and the inter-ministerial steering committee of the Mission will be chaired by the CEO of Niti Aayog. The Mission aims to create a Phased Manufacturing Program (PMP) for five years till 2024, to support setting up large-scale, export-competitive integrated batteries and cell-manufacturing giga plants in India, as well as localizing production across the entire electric vehicle value chain.

States/union territories policy

As of today, 27 states and UTs have formulated strategy plans for transforming mobility to provide their citizens with safe, inclusive, economic, and clean transport options. While some states like Karnataka and Tamil Nadu have had a head start due to preplanned public policies, targeted investor incentives, as well as support infrastructure, other states too have drafted policies to stimulate market demand and create infrastructure.

Challenges faced by EV industry

- Insufficient charging infrastructure: In 2019, there were only 650 charging stations in India as against over 0.3 million in China. Lack of sufficient charging infrastructure is one of the primary reasons why customers often refrain from purchasing EVs.

- High costs: Along with the range anxiety (kms/charge), another major concern among the potential customers is the current high price of EVs. As compared to lower-end (internal combustion engine) ICE cars, electric cars in the same segment tend to be more expensive. This is mainly because of the higher cost of technology used in the EVs, which constitutes a substantial portion of the cost, not leaving much scope for other features usually available in premium cars. It is expected that in future, with increased R&D and market competitiveness, the price factor will be rationalized to suit the price sensitivity, which in India is a primary factor influencing purchase, especially in the lower-end car segment.

With the recent announcement of subsidies, the price rationalization of EVs in the two-wheeler segment is on cards. Since the government’s fast-changing priorities are now biased towards sustainable, clean electric mobility, industry watchers expect a similar push towards easing adoption of other electric vehicles like cars and buses soon. - Limited options: Since it is still a budding industry in India, customers have a very limited range of products to choose from. Increased investment in the sector will make it more competitive in due time and this will help create further demand.

- Lower mileage: Since the industry is young, there is immense scope for R&D. As of today, EVs in India are not cost competitive to an average customer as internal combustion engine (ICE) vehicles prove to be more cost effective.

- Higher dependency on imports: Reliance on imports of battery as well as other components is also one of the factors adding to the cost of EVs in India.

- Grid challenges: Another concern is regarding the price of charging EVs at private charging stations once EVs become mainstream. According to Brookings India, projections for 2030 show that even with a fair penetration of EVs, the increase in demand for electricity is likely to be about 100 TWh (tera watt-hours) or about four percent of the total power generation capacity. So, increasing methods of power generation are necessary to meet that growth in demand.

Key takeaways

Ultimately, the scope of India’s EV market growth rests on availability of capital for original equipment manufacturers, battery manufacturers, and charge point operators as well as improvements to infrastructure and diversified options for consumers.

Realizing India’s EV ambition will also require an estimated annual battery capacity of 158 GWh by FY 2030, which provides huge investment opportunities for investors. Enabling policy support measures are a critical need at this juncture.

The government appears to be aware of this; it has been rolling out incentives to boost market demand in priority segments like electric two-wheelers, and localizing production of key components like ACC battery storage through the PLI scheme.

This article was originally published on March 11, 2021. It was last updated June 15, 2021.

About Us

India Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Delhi and Mumbai. Readers may write to [email protected] for more support on doing business in in India.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, Singapore, Vietnam, Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.